There is no overarching theme to this year’s collection of my favourite Wellington photos. Walking our still fairly new dog has taken me to some new places – it amazes me that a neighbourhood of nearly twenty years can still hold secrets – but otherwise most pictures are of sights I knew well. None more so than St Mary’s Church in Berhampore, which I pass at least twice a day, but had never managed to photograph before because I had never seen it without a car in front.

(The photo was kindly ‘straightened’ by I.K.Bonzumpferl – if you follow the link you’ll see how he did it.)

This year I’ve also had the opportunity to write about some of these very familiar places. I used this photo of the survey mark at Mount Albert to illustrate a part of ‘my day’ for Popula.

Whereas this photo was the header for an article on our airport.

Speaking of the airport, the new control tower was opened this year which means that the old one, famously plonked in the middle of a residential street, was finally put on the market as a house.

Whereas this may be one of the last ever photos of Erskine College before its demolition began. The vantage point was across the valley, on one of those ‘new’ dog walks.

I like taking these photos from afar, which my little Panasonic is good at. The Berhampore Community Centre seen from MacAlister Park looks like a scake model.

This is the old Saint James’ church, converted into apartments.

Whereas the Monastery (seen here from Hutchison Road)

and Saint Cuthbert’s in Berhampore are still denominational.

The rest of the set, in no particular order: a pōhutukawa seen from our window during an exceptionally dry spell last summer.

Another pōhutukawa at MacAlister’s Park.

This mushroom in the Mornington golf course.

This tui on a wire in Farnham Street.

A chaffinch near the zoo.

Some pleasingly geometrical windows. The police headquarters:

The Crowe Hortwath building:

Along Lambton Quay:

The Central Fire Station always looks its best against a blue sky.

Whereas in this one the sea is trying to impersonate the sky over Miramar.

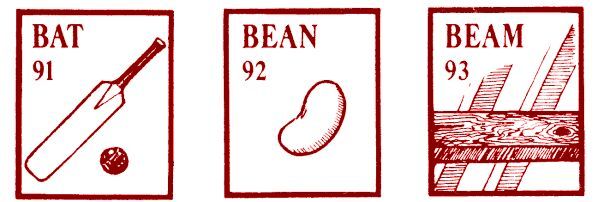

Dilruwan Perera edges the ball to the keeper on the first day of the first test against Sri Lanka at the Basin Reserve. The ball is near the edge of the picture on the right, between two palings.

Amateur cricketers play in the low clouds.

Newtown houses.

A teachers’ strike is one of the most majestic views in nature.

And another labour-themed image to finish: the low-relief sculpture outside Anvil House.

I’ll see you all next year.